-

-

-

Loading

Loading

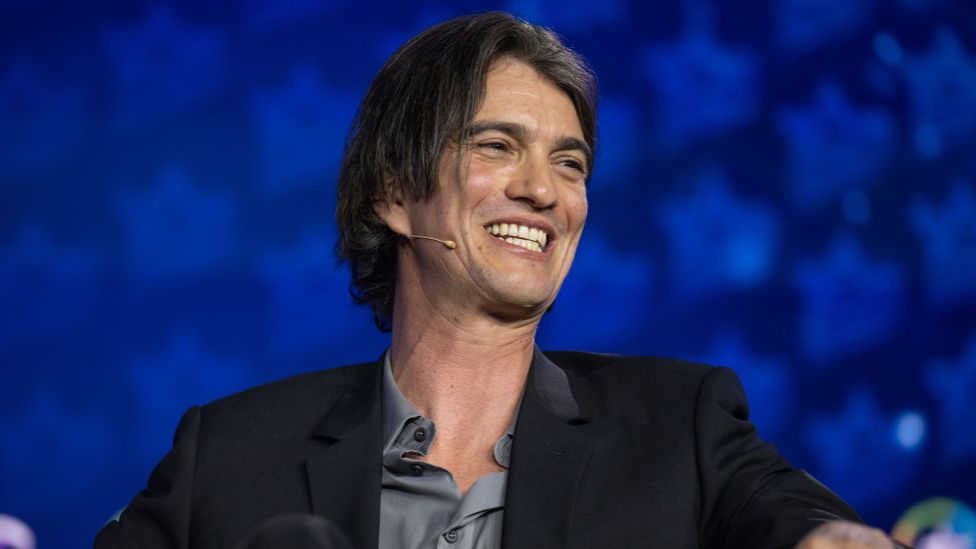

Former WeWork CEO Adam Neumann has expressed interest in buying back the bankrupt shared office company, according to a letter from his lawyer. The letter, made public on Tuesday, stated that Neumann approached WeWork in December about a potential deal but accused the company of resisting the idea despite its dire financial situation. WeWork responded by stating that it receives offers regularly and is focused on the best interests of the company. They believe that their efforts to address unsustainable rent expenses and restructure the business will ensure WeWork's long-term success as an independent and financially strong company. Neumann was forced out of WeWork in 2019 after a failed attempt to list the company on the stock exchange, which exposed its financial weaknesses and raised concerns about his leadership. The company's situation worsened when offices shut down during the pandemic, leading to its filing for bankruptcy protection last November. Neumann, who now leads a new property firm called Flow, approached WeWork in December about a potential deal. However, WeWork initially resisted the offers, worried it could harm negotiations with landlords. The company eventually agreed to consider a financing proposal but has yet to provide information to inform Neumann's offer. Neumann's lawyer expressed disappointment with WeWork's lack of engagement, claiming that a takeover by Neumann could increase the value of the company. The letter revealed that Neumann is teaming up with investors, including hedge fund Third Point. WeWork released a statement stating that they have only had preliminary discussions with Neumann and Flow and have not made a commitment to participate in any transaction. The company, once heralded as the future of office spaces, expanded rapidly but ultimately faced unsustainable costs, resulting in billions of dollars in losses.